Table of Contents

- Is Filing an Extension a Bad Thing? What Do I Need To Know About Tax ...

- Do I Need to File a Tax Extension?

- Irs Extension Instructions at williamkhavard blog

- How to File an Extension for Taxes in 4 Steps

- When Are Business Tax Extensions Due 2024 - Vilma Jerrylee

- Tax Extensions: 12 Tips To Save You Money | Green Trader Tax

- Tax extension grunge rubber stamp on white background, vector ...

- Filing a tax extension - Diamond & Associates CPAs

- File Extension Taxes 2025 Free Pdf - Sophia M. Gaertner

- A Complete Guide to Business Tax Extension

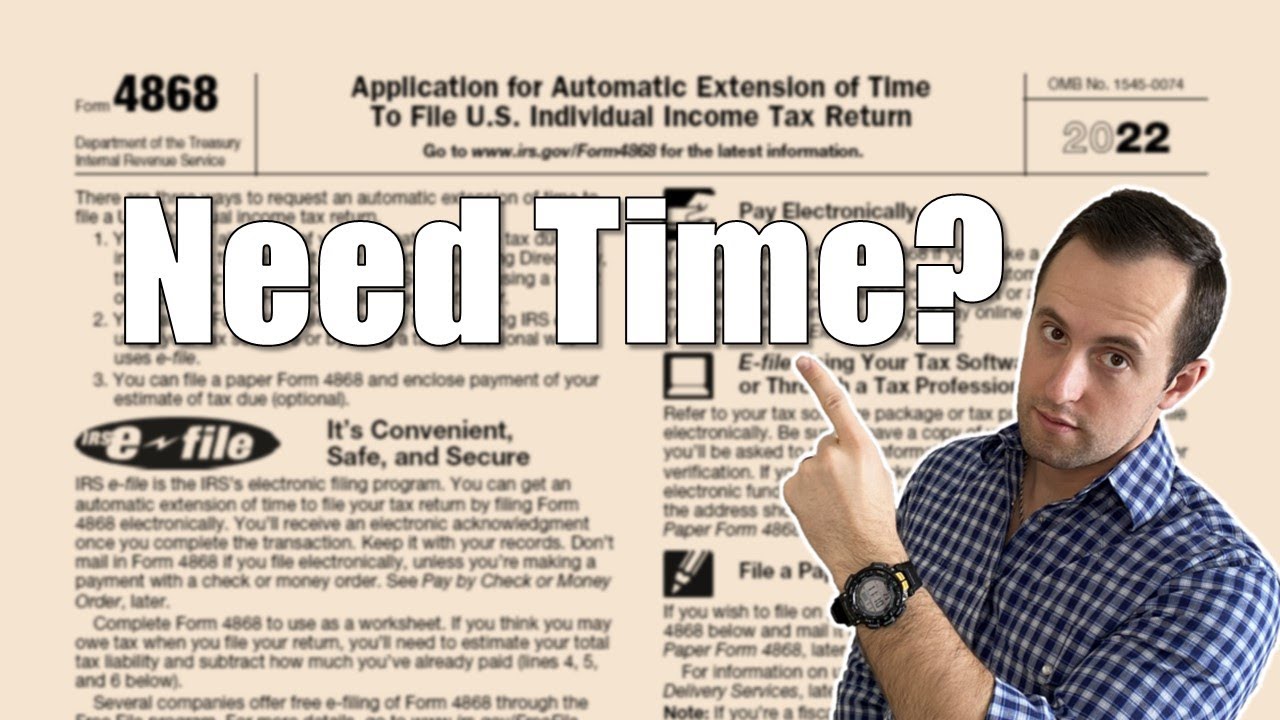

What is Form 4868?

Who Can File Form 4868?

How to File Form 4868 with H&R Block

Filing Form 4868 with H&R Block is a straightforward process. Here's how: 1. Log in to your H&R Block account: If you're an existing H&R Block customer, log in to your account. If not, create a new account. 2. Select the "File an Extension" option: Click on the "File an Extension" option and follow the prompts. 3. Fill out Form 4868: H&R Block will guide you through the process of filling out Form 4868. You'll need to provide your personal and tax information. 4. Estimate and pay taxes due: Estimate and pay any taxes due to avoid penalties and interest. 5. Submit Form 4868: Once you've completed the form, submit it to the IRS through H&R Block.

Benefits of Filing an Extension with H&R Block

Filing an extension with H&R Block offers several benefits, including: More time to file: Get an additional six months to file your tax return. Avoid penalties: Avoid penalties and interest by estimating and paying taxes due. Easy and convenient: H&R Block makes it easy to file Form 4868 online. Expert guidance: H&R Block's tax experts are available to guide you through the process. Filing an extension with Form 4868 and H&R Block is a simple and convenient way to get more time to file your tax return. By following the steps outlined above, you can easily file for an extension and avoid penalties and interest. Remember to estimate and pay any taxes due by the original deadline to avoid additional penalties. With H&R Block, you can file your taxes with confidence and get the expert guidance you need to navigate the tax filing process.File your taxes with confidence using H&R Block. Visit H&R Block today to learn more about filing an extension with Form 4868.