Table of Contents

- Nowa definicja budowli dla celów podatku od nieruchomości od 2025 r ...

- Tax Free Gifting 2025 - Kitti Nertie

- The Tax Year-end Checklist | Netwealth Webinars - YouTube

- Income Tax Prep Checklist Free Printable Checklist Tax Prep | Hot Sex ...

- Bmw Championship 2025 Tee Times - Minna Sydelle

- Tax Prep Checklist Tracker Printable | Tax Prep 2023 | Tax Tracker ...

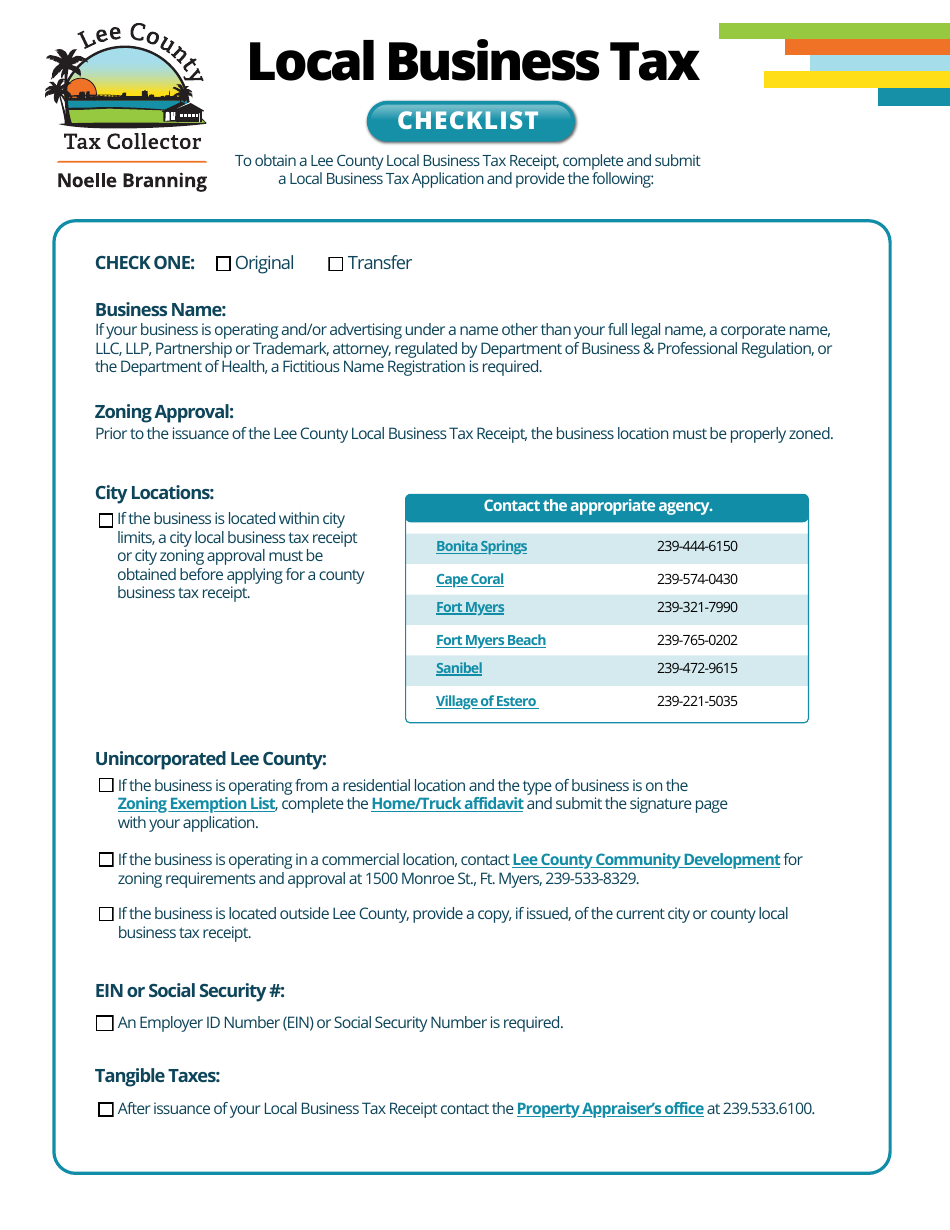

- Lee County, Florida Local Business Tax Checklist - Fill Out, Sign ...

- 2025 Tax Guide Pdf - Emylee Lindsy

- 2025 Estate Tax Exemption | Mariner

- Tax Threshold 2025 - Kitti Nertie

Understanding the Importance of Tax Documents

Income-Related Documents

Deduction-Related Documents

To claim deductions, you'll need the following documents: Receipts for charitable donations: Keep receipts for donations to qualified charitable organizations. Medical expense receipts: Gather receipts for medical expenses, including doctor visits, prescriptions, and hospital bills. Mortgage interest statements: If you're a homeowner, you'll need statements showing mortgage interest paid. Property tax statements: Keep records of property taxes paid on your primary residence or investment properties.

Credit-Related Documents

To claim tax credits, you'll need the following documents: Child care expense receipts: If you're claiming the child tax credit, keep receipts for child care expenses. Education expense receipts: If you're claiming education credits, gather receipts for tuition, fees, and other education-related expenses. Energy-efficient home improvement receipts: If you've made energy-efficient improvements to your home, keep receipts for these expenses.